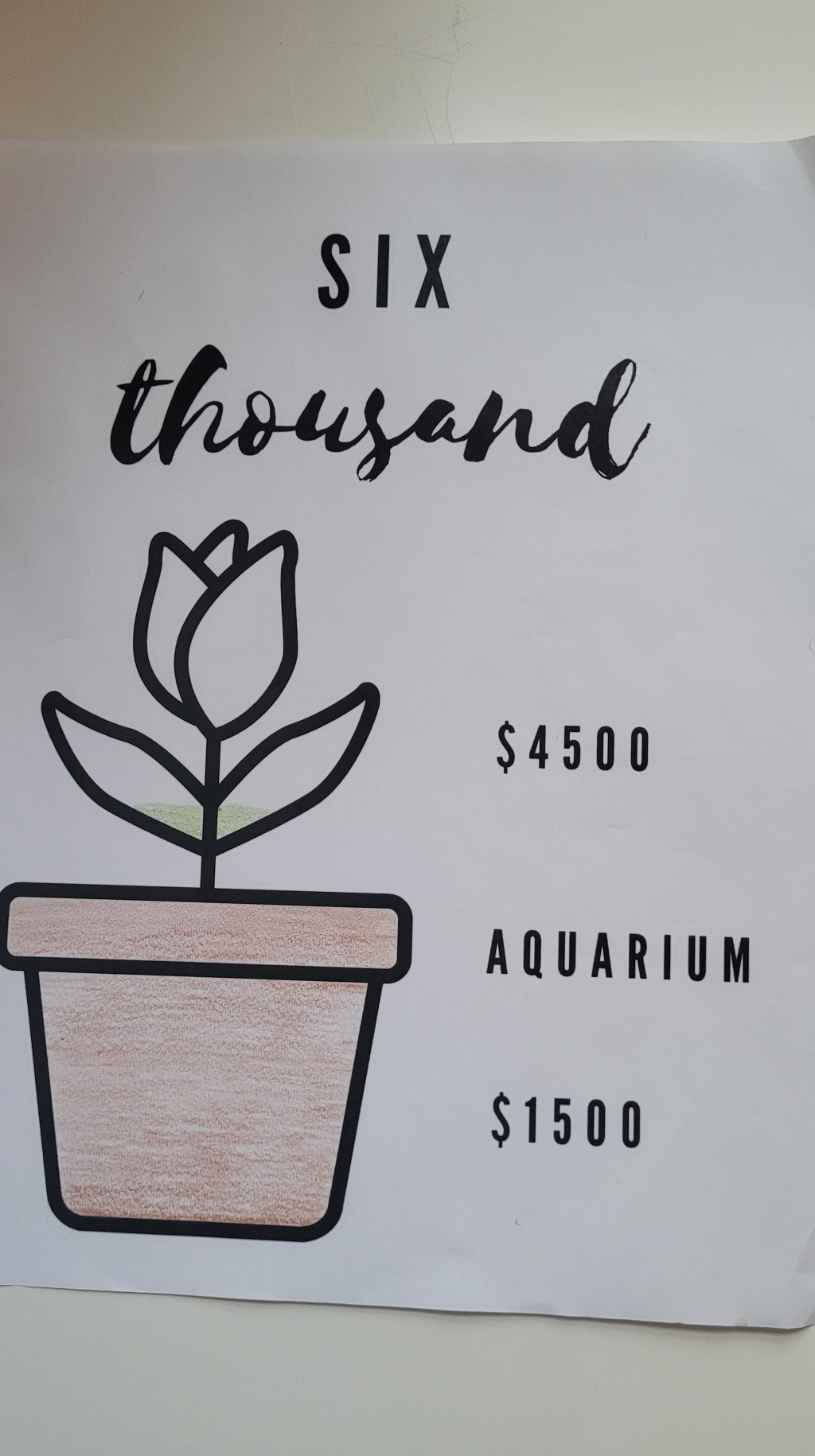

As of April 28th, I had only saved $3833 of my $6k goal for the moving deposit. So I fell significantly short. Which ultimately is not surprising. A goal of $6k in disposable income over what wound up being only 4 months is super tough given today’s economy. Of course, it did not help that my partner and I continued to plan and pay for experiences and trips, which diminished my ability to save.

Thankfully, I am able to lean on my partner who has significantly more savings. In total, we owed $7100 for the first, last, security, and realtor fees. The goal was that I would pay the $1000 realtor fee with what I saved and he’d pay the rest. Everything else I had saved would be held for about a month or two in case we needed furniture we couldn’t/didn’t want to get second-hand. Whatever was left over at the end of that time frame would go towards paying off my debt.

For the $1000 that was my responsibility I decided to take only $500 from my savings and the other $500 would be from the funds in my checking account. That leaves me with $3,333 in savings. I don’t know as of yet how much will go towards furniture. But I want to lay out my debt payoff plan now so when the time comes I have a clear path to follow.

I have two primary sources of debt: my car loan and my student loans. The car loan is one loan of $21,119 with an APR of 5.75%. The student loans however are an amalgamation of different individual loans. The total for my student loans is $57,872 and the interest rates vary from 2.75% to 5.28%. Those immersed in the debt payoff world will know there are two primary methods: avalanche and snowball.

Both methods have you pay the minimum on all loans the difference is involved in any extra payments. The avalanche method has you put the extra payments towards the biggest loans or the ones with the highest interest rates you then move onto smaller loans. The snowball method has you pay off the smallest loan first and then move on to the larger loans. With each of these methods, once the first loan is paid off the minimum payment for that first loan as well as any extra payments get made to the next loan in line.

Predictably, the avalanche method takes a lot longer to see that initial success but, it’s a large success once you have that momentum of success it keeps growing pretty quickly. Meanwhile, the snowball method sees a small success early on, but it takes longer for that momentum to build. The big perk of the snowball method is that initial feeling of success and reward, for some that increases their follow through with the plan. And I know I need that initial feeling of success, but I don’t want to leave the most difficult to the end. So I’m going to do a very personalized mix as detailed below.

Loan 4 Unsubsidized – $1835 at 5.05% interest

Car Loan – $5k (5.75% interest)

Loan 2 Unsubsidized – $2,119.75 at 4.45% interest

Car Loan – $5k

Loan 3 Subsidized – $4,560.39 at 5.05% interest

Loan 1 Subsidized – $4,515.05 at 4.45% interest

Car Loan – $5k

Loan 6 Unsubsidized – $7,034.86 at 4.53% interest

Loan 5 Subsidized – $5,525.77 at 4.53% interest

Car Loan – pay off the remaining total

Loan 9 Unsubsidized – $20,189.28 at 5.28% interest

Loan 8 Unsubsidized – $6,729.06 at 2.75% interest

Loan 7 Subsidized – $5,362.62 at 2.75% interest

I highly suspect this will take me years. I don’t want to set my expectations too high or too low but with nearly $80k in debt, I suspect it will take me at least a decade, unless my circumstances dramatically change. I of course will be documenting my debt payoff plan on this blog. I think I’ll limit myself to monthly updates on those extra payments and celebrations anytime I hit one of the above milestones.

Leave a comment